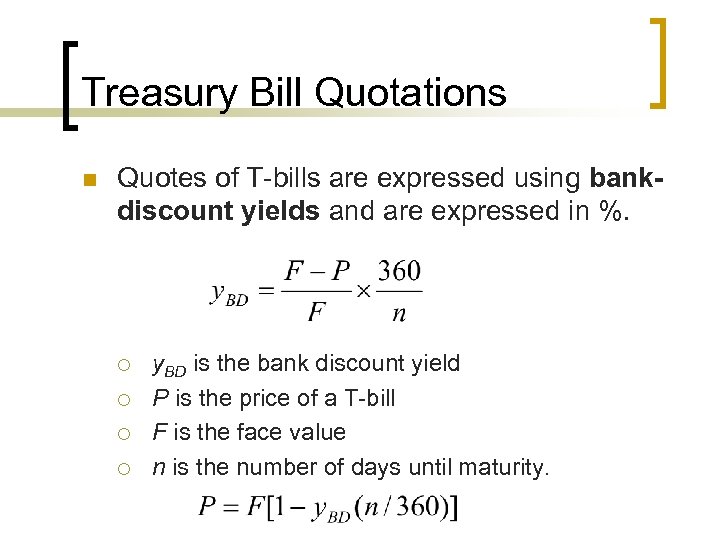

For information on recent auctions, see. For example, if you buy a $1,000 bill at a price per $100. The yield is calculated in the paragraphs following the table.

Religion And Politics Don T Mix Quotes

Please Don T Make Me Angry Quotes

When Things Don T Go The Way You Want Quotes

Interest Rates and Money Treasury Bills n

This page explains pricing and interest rates for the five different treasury marketable securities.

Of the debt issued by the u.s.

A plus constitutes ½ of 1/32, and six constitutes 6/8, or ¾, of 1/32. Government debt obligation backed by the treasury department; A us treasury bill is an incredibly safe yet short term bond with is provided by the united states government and also has a maturity period of less than. Debt securities that mainly differ in the length of maturity (shortest to longest).

Treasury bills are usually sold in. If a bill has an interest rate of 1.9%, you’re only actually making 1.9% if the bill is due in a year. First try secondary market t notes/t bills to buy & hold to maturity, but what if we have to do it in taxable account? These debt obligations are issued in maturities of four, 13.

Treasury bill futures aim to.

Treasury bills, notes and bonds are three types of u.s. The 1.9% is an annualized yield. Practical mechanics remain a barrier to. Treasury bills, or bills, are typically issued at a discount from the par amount (also called face value).

Treasury bond quotes may appear confusing, but if you understand a few of the basics, they give you all the information you need to make an investing decision. Treasury bill quotes can look complicated, but it’s pretty easy to figure out the price. Us treasury bills, commonly known as t bills, are certificates of debt issued by the united states government that have a maturity date of. Treasury bills can be purchased in the following three ways:

It typically has a maturity of a year or less.

:max_bytes(150000):strip_icc()/Treasurybill-b7a8fc4ccac04973867613f77851b732.jpg)